The Hidden Costs of Fleet Accidents: How AI Security Can Slash Your Insurance by 25%

Great question! For WordPress scheduling to work properly, you should have it set to "Publish Immediately" , but here's the key part: you then change the date/time in the "Publish" box to the future date you want.

When you set a future date with "Publish Immediately" selected, WordPress automatically changes the blue button from "Publish" to "Schedule." That's the magic moment. Click that "Schedule" button and you're all set.

If you leave it on "Save as Draft," WordPress will never auto-publish it regardless of the date.

Now let me reset and recreate those 4 posts. Here's the first one for Thursday, January 29th:

Fleet accidents create financial shockwaves that extend far beyond the initial repair bill. Most fleet managers understand the direct costs: deductibles, repairs, medical expenses: but the hidden costs can be two to three times more expensive than what appears in traditional metrics. Understanding these overlooked expenses is the first step toward controlling them.

The good news? Modern video telematics solutions equipped with artificial intelligence are giving fleet operators the tools to fight back. By capturing objective evidence, identifying risky behavior, and demonstrating a commitment to safety, these systems are helping companies reduce insurance premiums by up to 25% while protecting their bottom line from catastrophic liability.

The True Cost of Fleet Accidents: What the Numbers Don't Show

When a fleet vehicle is involved in an accident, the visible expenses represent only a fraction of the total financial impact. Industry research reveals that uninsured losses can reach $8 to $53 for every $1 insurers pay out. That ratio should give every fleet manager pause.

Here's where the money actually goes:

Workers' Compensation and Injury Claims

Vehicle-related workers' compensation claims average $90,914 per claim. More than half of collision-related injuries result in missed work, triggering additional costs through disability coverage, health insurance claims, and paid sick leave. A single serious accident can impact payroll and benefits budgets for months or even years.

Operational Downtime

Every vehicle sitting in a repair shop is a vehicle not generating revenue. Accidents trigger missed service-level agreements, overtime expenses for remaining drivers, vehicle rental costs, and significant administrative burden across HR, operations, and finance departments. These costs are notoriously difficult to track but accumulate quickly.

Insurance Premium Increases

The base premium is just the starting point. Hidden charges include administrative surcharges, specialty endorsements, and state-based risk adjustments. Following a claim, fleet operators can expect annual premium increases of 10–20%. Experts recommend budgeting an additional 10–30% of your base premium for add-ons and contingencies.

Repair Cost Inflation

Modern commercial vehicles equipped with advanced driver assistance systems (ADAS) and integrated technology command significantly higher repair costs than their predecessors. Medical liability claims and legal fees are rising faster than general inflation, sometimes resulting in claims 30–50% higher than expected.

Long-Term Financial Impact

Beyond the immediate aftermath, accidents create ripple effects that last for years. Litigation costs, reputational damage, difficulty recruiting quality drivers, and increased employee turnover all contribute to the true cost of poor fleet safety.

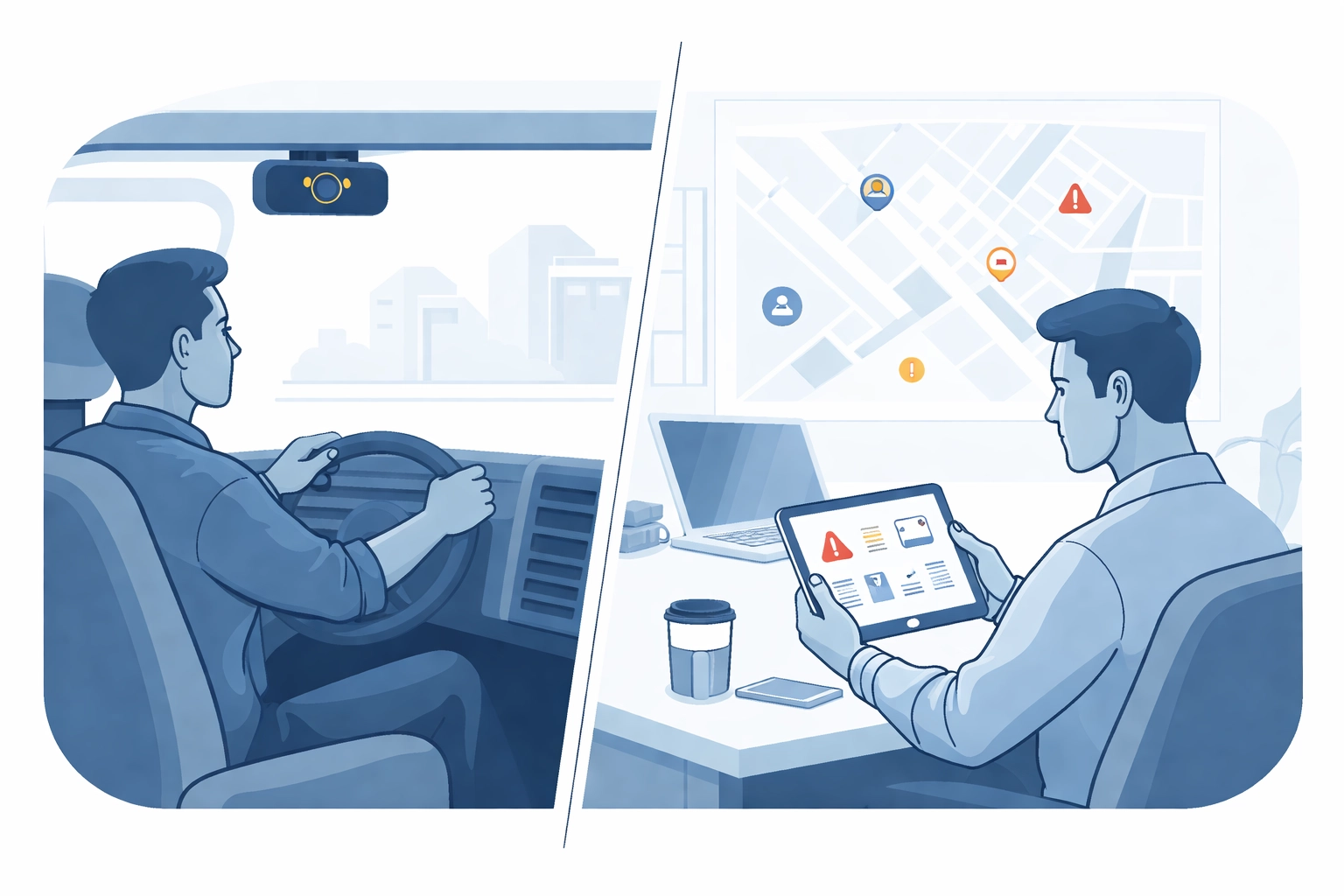

How Video Telematics Solutions Change the Equation

Traditional fleet safety programs rely on training, policies, and reactive responses to incidents. Video telematics solutions add a proactive layer that transforms how companies prevent accidents and manage their aftermath.

Modern AI dash cameras for fleets combine high-definition video recording with artificial intelligence that can identify risky driving behavior in real time. These systems capture both road-facing and driver-facing footage, creating a complete picture of every incident.

The technology works on multiple fronts:

Real-Time Driver Coaching

AI-powered cameras detect behaviors like distracted driving, following too closely, hard braking, and lane departure. Instead of waiting for an accident to identify a problem driver, fleet managers receive immediate alerts and can address risky behavior before it leads to a collision.

This proactive approach reduces accident frequency over time. Drivers who know their behavior is being monitored tend to drive more carefully, and those who receive coaching improve their performance measurably.

Objective Evidence for Every Incident

When accidents do occur, video evidence eliminates the guesswork. Insurance adjusters, attorneys, and law enforcement no longer need to rely solely on witness statements or accident reconstruction. The footage shows exactly what happened.

This objectivity benefits fleet operators in several ways:

- Exoneration from false claims: Studies suggest that commercial vehicles are not at fault in a significant percentage of accidents, yet they often face liability simply because of their size. Video evidence proves fault conclusively.

- Faster claim resolution: Clear evidence speeds up the investigation process, reducing administrative costs and getting vehicles back on the road sooner.

- Protection against fraud: Staged accidents and exaggerated injury claims cost the trucking industry billions annually. Video footage is the most effective deterrent.

Data-Driven Risk Management

Beyond individual incidents, video telematics platforms aggregate data across the entire fleet. Fleet managers can identify patterns: specific routes with higher incident rates, drivers who need additional training, or times of day when accidents are more likely.

This data enables targeted interventions rather than blanket policies that may not address the actual risks.

The Insurance Premium Connection

Insurance companies are in the business of assessing risk. When a fleet operator demonstrates a genuine commitment to safety through technology investment, insurers take notice.

AI dash cameras for fleets signal to underwriters that a company is serious about preventing accidents, not just reacting to them. Many insurance providers now offer specific discounts for fleets equipped with video telematics, recognizing that these systems reduce both the frequency and severity of claims.

The path to lower premiums typically involves:

- Installation verification: Insurers want confirmation that cameras are installed across the fleet and actively recording.

- Policy integration: Video footage must be available for claim investigations, and the fleet must have clear protocols for preserving and sharing evidence.

- Demonstrated results: Over time, a track record of fewer claims and faster resolutions builds credibility with underwriters.

Fleet operators who implement comprehensive video telematics programs report premium reductions ranging from 10% to 25%, depending on their baseline risk profile and the specific insurer. For a fleet spending $500,000 annually on insurance, a 25% reduction represents $125,000 in direct savings: every year.

Calculating the Return on Investment

The financial case for video telematics extends beyond insurance savings. A complete ROI calculation includes:

Direct Insurance Savings

Premium reductions provide immediate, measurable return. These savings compound annually as the fleet's safety record improves.

Avoided Accident Costs

Every prevented accident eliminates not just the direct expenses but all the hidden costs outlined above. Even a modest reduction in accident frequency can save hundreds of thousands of dollars over time.

Reduced Litigation Exposure

Video evidence dramatically improves outcomes in disputed claims. Fleets with camera systems report faster settlements and lower legal fees. The ability to quickly exonerate drivers from false claims alone can justify the investment.

Operational Efficiency Gains

Many video telematics platforms integrate with broader fleet management systems, providing insights into routing efficiency, idle time, and vehicle utilization. These secondary benefits add to the overall value.

Driver Retention

Professional drivers appreciate working for companies that invest in their protection. Video evidence that exonerates drivers from false accusations builds loyalty and reduces turnover: a significant cost factor in today's competitive hiring environment.

For most fleets, video telematics systems pay for themselves within the first year through a combination of these factors. The ongoing savings continue to accumulate year after year.

Making the Transition

Implementing AI dash cameras for fleets requires planning but doesn't need to be complicated. Modern systems are designed for straightforward installation and intuitive management interfaces.

Key considerations include:

- Camera placement and coverage: Dual-facing cameras (road and driver) provide the most complete protection.

- Cloud storage and retrieval: Footage must be easily accessible when needed for claims or coaching.

- Integration with existing systems: The best platforms connect with GPS tracking, ELD systems, and fleet management software.

- Driver communication: Transparent policies about how footage will be used build trust and acceptance.

For a deeper look at integration options, explore our guide on fleet dash cam integration or learn more about the benefits of real-time fleet video telematics.

Taking Control of Fleet Safety Costs

The hidden costs of fleet accidents represent a significant drain on profitability, but they are not inevitable. Video telematics solutions give fleet operators the visibility and evidence they need to prevent accidents, protect their drivers, and demonstrate their commitment to safety.

Insurance premium reductions of up to 25% are achievable for fleets that embrace this technology. Combined with reduced accident frequency, faster claim resolution, and protection against fraud, the financial case is compelling.

The question is no longer whether AI-powered video telematics makes sense for fleet operations. The question is how quickly you can implement it and start capturing the benefits. Contact Safety Track to learn how video telematics can transform your fleet's safety profile and reduce your insurance costs.

Tyler Schneider is the IT Director at Safety Track, overseeing the company’s technological infrastructure and innovations. With a strong background in information technology and systems management, Tyler ensures that Safety Track stays at the forefront of tech solutions in fleet management. His strategic expertise supports the seamless integration of technology across the company’s operations.